Debt solutions

DMP - Debt Management Plan

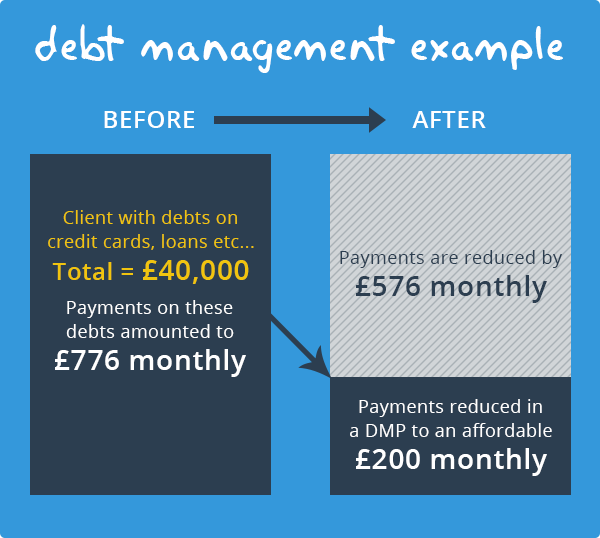

A DMP ( Debt Management Plan) is an informal debt solution where you repay your debts with a fixed lower monthly repayment that is affordable for you. It is suited for people who are struggling to make their debt payments each month. In a DMP, a Debt Management Company assesses what you can afford to pay and then negotiates with all of your creditors to have the payments reduced. They will try and get interest and charges frozen on your debts, but this is not guaranteed. Because a DMP is an informal solution, you can opt out at any time.

Advantages of A DMP

- An informal agreement that can be stopped at any time

- 1 easy monthly payment to cover your debts

- Payments can be varied to suit your circumstances throughout the plan

- Interest and charges could be frozen (but is not guaranteed)

- Creditor pressure is eased

- The Debt Management Company will oversee and handle your plan for it's duration

Disadvantages of A DMP

- A DMP will remain on your credit file for it's duration (and after completion if a default notice has been issued)

- Debt Level can increase if creditors refuse to freeze interest and charges

- Debts will be repaid over a longer period of time than if contractual payments were made

- Debts must be repaid in full, unless you decide to opt out of the plan and return to normal repayments.

- Your ability to obtain credit will be affected in the short term, and possibly the medium to long term

IVA - Individual Voluntary Arrangement

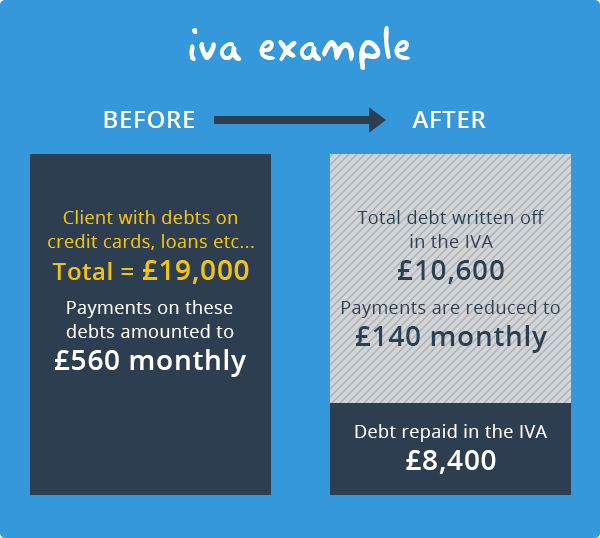

An IVA is a formal debt solution suitable for people who have debts over £8,000 and cannot afford to keep up with the repayments. In an IVA you repay your debts at an amount that is affordable to you, usually in the form of monthly payments spread out over 60 months. On completion of the payments, any debt still outstanding is written off and you start over free of debt.

You will require the help of an Insolvency Practitioner to do an IVA. This is the qualified professional who is responsible for preparing, negotiating and overseeing your arrangement after it has been agreed by your creditors. Because an IVA is a formal solution, it provides you with legal protection from your creditors and they will be bound by it's terms.

Advantages of An IVA

- 1 easily affordable monthly payment based on your income and expenses

- No hidden upfront fees or hidden fees

- An IVA offers you protection from creditors

- Creditor pressure is stopped as creditors will have to deal with all issues through us

- An IVA can be complete in as little as 1 year if you can offer a lump sum payment

- All interest and charges are frozen as soon as your IVA begins

- Any remaining debts are written off on completion

- An IVA is suitable for Tenants or Homeowners, individuals or couples, and also business owners.

- Your Insolvency Practitioner / Insolvency Company will oversee your IVA from start until completion.

Disadvantages of AN IVA

- You IVA is entered on a Public Register

- If you are a Homeowner with equity in your property you may be required to introduce part of your share of this equity in the final year of the arrangement by means of a remortgage. If you can’t get a remortgage you might have to continue making monthly payments for up to 1 more year.

- If your circumstances change, and your insolvency practitioner can’t get creditors to accept amended terms, the IVA is likely to fail. You will still owe your creditors the full amount of what you owed them at the start, less whatever has been paid to them under your IVA.

- If your IVA fails, your creditors may request that you be made bankrupt

- Your credit rating may be impacted for the duration of the IVA.

DRO - Debt Relief Order

A DRO or Debt Relief Order is like a cheaper form of Bankruptcy that is suitable for people who have debts under £20,000, with little or no assets and very little or no money (under £50) left over each month to pay their debts. The fee for a DRO is £90 (payable to the Insolvency Service) and can be made in instalments. The fee must be paid before the Debt Relief Order application can be made.

Advantages of A DRO

- Your debts will be written off at the end of the Debt Relief Order, with exceptions

- Creditors involved in the DRO cannot take further action against you, without court permission

- A DRO is complete after 1 year.

- The DRO fee is a lot more affordable than Bankruptcy fees and can be paid in instalments before the application is made.

- You can keep your assets (not exceeding £1,000) and a vehicle (not exceeding £1,000)

Disadvantages of A DRO

- A DRO is entered on a public register

- Only an approved intermediary can complete a DRO

- You cannot have a DRO if you are a homeowner

- You will still be responsible for paying certain debts such as Student Loans, fines and debts arising from family proceedings.

- Your employment could be affected

- Your DRO could be withdrawn if you do not cooperate with the Official Receiver during the year that your DRO is in place.

- You cannot act as a company director or manager unless the court agrees.

- You will be committing an offence if you obtain credit of £500 or more without disclosing that you are subject to a DRO.

- You may have a Debt Relief Restrictions Order made against you if you have behaved irresponsibly, recklessly or dishonestly.

Bankruptcy

Bankruptcy is a formal debt solution handled through the court and is suitable for people who are unable to pay their debts. Bankruptcy is normally seen as a last resort option because of the implications it imposes, so it is worth exploring other options beforehand. You can apply to become bankrupt yourself or if you owe more than £5,000 to your creditor/s they can apply for your Bankruptcy.

In Bankruptcy your assets are sold to help pay your creditors. Bankruptcy normally lasts for about 1 year. If you have a surplus income each month, this might have to go towards the Bankruptcy also and can be paid for up to 3 years. At the end of your Bankruptcy your creditors cannot make any further claims against you for any debts owed.

where you repay your debts with a fixed lower monthly repayment that is affordable for you. It is suited for people who are struggling to make their debt payments each month. In a DMP, a Debt Management Company assesses what you can afford to pay and then negotiates with all of your creditors to have the payments reduced. They will try and get interest and charges frozen on your debts, but this is not guaranteed. Because a DMP is an informal solution, you can opt out at any time.

Advantages of Bankruptcy

- Provides peace of mind

- You could be discharged from Bankruptcy after as little as 1 year

- Debts are written off (with some exceptions)

- You are protected from your creditors taking any further action, unless debts are secured against an asset

- You may be able to avoid selling your home providing a partner

Disadvantages of bankruptcy

- Your Bankruptcy is advertised in the local press and is entered on a public register

- If you rent your landlord may be notified or find out about your Bankruptcy

- If you apply for your own Bankruptcy you will be expected to pay a court fee and deposit

- Your employment may be affected

- You lose control of your assets

- You cannot obtain credit for over £500 without disclosing that you are bankrupt

- Your credit rating will be affected for many years after the Bankruptcy has taken place

- Certain debts cannot be included in the Bankruptcy - Student Loans, Fines and debts arising from family proceedings

- If you own a business, it will be closed down

- You may have a BRO (Bankruptcy Restrictions Order) made against you if you have behaved irresponsibly, recklessly or dishonestly