Is an IVA the right choice for you?

There is specific criteria involved in doing an IVA. Contact us to find out if youqualify. We will run through an assessment to determine if an IVA is the right option for you, as well as running you through any other possible options that you might want to consider.

An IVA might be a suitable solution for you if

- You have debts above £8,000.

- You owe debts to 2 or more creditors.

- You cannot afford to repay your debts.

- You have some income left over each month after paying all of your household living expenses and bills (but not including your debt repayments).

- You live in England Wales or Northern Ireland. (You cannot do an IVA in Scotland. There is a similar solution called a Trust Deed available for scottish residents)

Example of an IVA

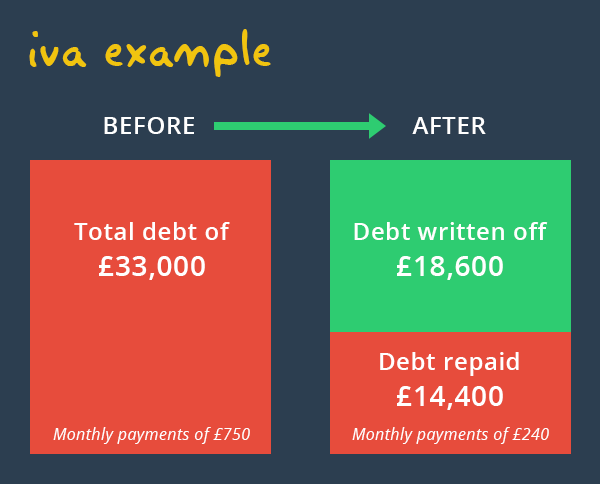

Our client was struggling to keep up with monthly payments of £750 on credit cards and loans totalling £33,000. They contacted us to find out what help was available.

After analysing their situation it was determined that they could realistically afford to pay £240 per month after all essential living costs were taken care of. They decided that an IVA was their best course of action.

We were able to agree an IVA with their creditors where they paid reduced monthly payments of £240. At the end of the IVA they will have repaid a total of £14,400 (44% of their total debts) and the remaining debt of £18,600 will be legally written off.

IVA Questions and Answers

- Contact us on 0800 043 5133 or fill out our form above.

- Tell us about your circumstances, debts, income, living costs. Tell us about anything you have to pay out regularly so that we understand your situation in full.

- We will then discuss your options and explain them all in detail so you can understand what options are available to you and the implications of each.

- If an IVA is appropriate for your circumstances and you want to proceed with it, we can start working on your IVA proposal.

- Once we have drafted your IVA proposal we send it to you for your review and signature.

- We contact your creditors with your signed IVA proposal and ask them to accept it. This involves negotiating with them, so the more we understand your situation the better we will be able to explain it to them.

- Upon acceptance of your IVA you will start making your payments as agreed in your proposal.

- Your IVA will be managed and reviewed throughout the duration of the agreement. This is to make sure that your payments and IVA are still affordable.

- Upon successful completion of your IVA any remaining debts will be written off and you will be able to start over debt free.

- Your credit rating is affected during an IVA, but will start to repair on completion and after 6 years from beginning your IVA.

- Overdrafts from bank and building society accounts

- Credit cards

- Store Cards

- Catalogues

- Unsecured loans

- Payday loans

- Hire purchase on products no longer needed

- Mobile phone contracts no longer needed

- Payments owed to repossessed properties, such as mortgage shortfalls

- Tax Debts - HMRC VAT, PAYE, Self Assessment tax, National Insurance

- Money owed to friends and family

- Court Fines

- Parking Tickets

- Student Loans

- Claims

- Guarantor Loans

- Secured loans

- Hire Purchase where you still require the item

In an IVA, we work out what you can afford by analysing your income and expenses. There are allowances set out by The Insolvency Service that help us to work out what reasonable living expenses are best for your situation and what you are paying for each month. Once we have calculated all expenses, the left over money that is available each month from your income is the money that is available to go towards your debts each month. This will be your proposed monthly IVA payment towards your debts.

An IVA usually lasts for 60 months (5 years). In some circumstances however, an IVA can be completed in a few months, but this would normally involve introducing a Lump Sum into the IVA.

In some circumstances, an IVA can last more than 5 years (ie if you are a homeowner with equity in your property). The length of time your IVA will last will be discussed and determined in the IVA proposal, once all of your circumstances have been taken into account.

There are different types of IVA. See below.

- Single IVA: all debts are in one person's name

- Joint IVA: debts can be in one or two person's names

- Self Employed IVA: Applicant is self employed. This type of IVA requires an accountant to work with the Insolvency Practitioner as it is important that the self employed person's business is understood. We are experts in this area. Assisted IVA: all debts are in one person's name but in order to be accepted payments need to be contributed to by someone else.

- Lump sum IVA: In this type of IVA, a lump sum payment is offered to creditors, instead of making monthly payments. This is generally the case where there is no monthly disposable income to offer and monies are available or offered by a third party. Creditors might accept a much reduced offer of payment in this type of IVA.

- 1 affordable monthly payment based on your income and expenses.

- With us there are no upfront or hidden fees.

- An IVA offers you protection from creditors.

- Fees for managing your IVA are agreed by creditors and come out of your monthly agreed payment to creditors, so you will never receive a bill from us.

- With us, if your IVA is not accepted by creditors, you pay nothing.

- Creditor pressure is stopped as creditors will have to deal with all issues through us.

- An IVA can be complete in as little as 1 year if you can offer a lump sum payment.

- All interest and charges are frozen immediately when your IVA is accepted.

- An IVA is suitable for tenants or homeowners, individuals or couples and even business owners.

- We have a fast set up period for IVA cases.

- We have a very high IVA acceptance rate. This is because we would never put forward an IVA on your behalf, unless it was your best option and also had a good chance of being accepted.

- Your IVA is entered on a public register.

- If you are a homeowner with equity in your property you may be required to introduce part of your share of this equity in the final year of the arrangement by means of a remortgage. If you can’t get a remortgage you might have to continue making monthly or quarterly ayments from your income for up to 1 more year.

- If your circumstances change for the worse, we will try to work with you to keep the IVA sustainable, by amending it's terms. If we can’t get creditors to accept the amended terms, your IVA could be at risk of failing. You will still owe your creditors the full amount of what you owed them at the start, less whatever has been paid to them under your IVA.

- If your IVA fails, your creditors may request that you are made bankrupt.

- Your credit rating may be impacted for up to six years from the commencement of your IVA.

You cannot do an IVA for free. An IVA requires the use of a professional (Insolvency Practitioner) to prepare, negotiate and administer your arrangement. It also requires the use of a supervisor to oversee your arrangement for it's lifespan. We are one of the few IVA companies who do not charge any upfront or hidden fees for an IVA, which means you will not be charged a penny if your IVA application is unsuccessful. Any fees we receive for managing your IVA come from your agreed monthly payments to your creditors. It is your creditors who determine what we are paid for your IVA case. They allow us to retain a small percentage of your payments to allow us to carry out all of the work to manage your IVA for the duration of your arrangement. You will NEVER receive a bill from us. We will create your IVA proposal and send it to your creditors without taking any payments from you. We operate a 'NO IVA : NO COST' policy. In the event that your creditors reject your IVA proposal you will not receive a bill from us.

Every IVA is unique and the offer that you put forward to your creditors will be based on your circumstances. All IVAs are different. You may not be able to offer monthly payments but sometimes we have clients that can offer a lump sum (redundancy payment, money from parents or friends, or simply savings for example). Creditors will look at any offer that we propose on your behalf. On occasions where the only offer available is a lump sum payment, creditors have been known to accept a repayment of less than 10p in the £ (10% of the original debt owed). It is also worth enquiring with us about an IVA because we may be able to help you in working out if you can actually free up money within your monthly budget, that you might not have been aware of. e.g. money that you were currently paying to your creditors that you cannot afford.

When your IVA is finished, the remainder of your debt is legally written off, making you essentially debt free. This will allow you to make a clean and fresh start to your finances. Your IVA company will send out your certificate of completion about 4 to 6 weeks after your final IVA payment.

Contact us at debtadvice.co.uk to discuss your situation. We will provide an assessment and work out whether or not an IVA is indeed the best course of action for you to take. We determine your suitability for an IVA by working out your income, expenditure and circumstances, taking into account your level of debt. We will also inform you of any other options available for dealing with your unaffordable debts.

If you decide to proceed with an IVA with us, we will draft your proposal and send it to you for agreement, then your creditors for voting. If more than 75% of your creditors (by debt value) agree to the IVA, your IVA can begin and it becomes legally binding for all parties involved. Provided you keep up to date with your monthly payments, your IVA will continue. We will regularly review your IVA to make sure it remains affordable. On completion of your IVA, you will become free from all the debts involved.

You do not have to sell your home in an IVA. Your house is protected in an IVA as long as you maintain your mortgage and IVA payments. If you have equity in your home, you may need to release it in the fourth or final yr. This will be discussed during the set up period of your IVA. The amount released is generally only a percentage of the equity. You might not be able to obtain a remortgage, in which case your IVA could be extended.

Most Creditors are aware of an IVA as it has been in force since 1986. If the majority of creditors by amount of debt (75% to be exact) agree with your IVA then all of your creditors are then bound by its terms. Before voting, creditors can request certain changes to the IVA proposal and you can choose whether or not to accept them. If your creditors vote against your proposal you still have the option of an informal arrangement.

Yes. Your credit rating is affected in an IVA. However if you are at the point of investigating an IVA as an option for addressing your debts, then it is possible your credit rating is already impaired. By entering into an IVA, your credit rating is affected for up to 6 years. After this time and when you have completed your IVA, your credit rating will begin to repair again.

When you enter into an IVA you must surrender all forms of credit (i.e. store cards, credit cards etc) and you will not be allowed to obtain any further unsecured credit until you are finished your IVA. You are entitled to use pre-paid cards.

nb. During an IVA, it is possible to take or change a mortgage but you will need to make sure you get advice from your Insolvency Practitioner for this.

We are part of McCambridge Duffy, who are one of the leading IVA providers in the UK. IVAs have to be supervised by an Insolvency Practitioner (IP). We have 5 full time Insolvency Practitioners in house. The reason for this is that we feel it is important that our clients are able to speak to their own Insolvency Practitioner if they wish. In most other IVA firms you would deal with supervisor staff who report to the firms IP. Our IPs are subject to regular inspections by their regulatory body. IPs are very highly regulated professionals and must be licensed to offer IVAs.

We have been established for well over 80 years and in this time we have gained an excellent reputation for the high standard of service we provide to our clients and creditors. You can read some client reviews here - McCambridge Duffy Client Testimonials